We would like to inform our readers that Transfer on Death Deeds (“TOD”) will become an option for property transfers in New York as of July 19, 2024. Real property such as a house, condominium unit or vacant land is currently transferred by deed. There are currently various types of deeds available for property transfers in New York State. A Referee’s Deed applies to the transfer of property by the Court appointed Referee after a foreclosure sale. An Administrator’s or Executor’s Deed is used by the fiduciary appointed by the Surrogate’s Court in an estate matter to transfer property to the proper person designated by the Will or who is entitled to the property according to intestacy. A seller in a standard real estate transaction will deliver a deed based on the level of quality of title promised to the buyer. Such deeds may be either a quitclaim or warranty deed, or a bargain and sale deed with or without covenants.

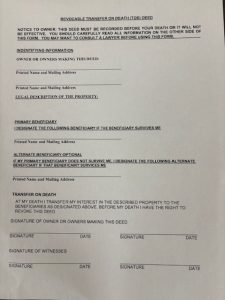

Our readers may be familiar with transfer on death designations on bank accounts whereby the account will automatically go to the designee upon the account owner’s death. Changes to the beneficiary can also be made during the account owner’s lifetime. TOD deeds will operate in much the same fashion. Such deeds will need to be signed before two witnesses and notarized before they are recorded before the owner’s death in the clerk’s office in the county in which the property is located. Similar to the standards in making a Will, the property owner needs to have capacity, not be under fraud or duress, or unduly influenced. The property owner retains control over the property and can sell or encumber the property with a mortgage. The designee of the property takes it subject to any liens or mortgages to which the property is subject at the property owner’s death. The transfer lapses if the beneficiary does not survive the owner, so it is necessary to provide for such a potential event by designating an alternate beneficiary in the TOD deed or by having a qualified attorney provide for such an occurrence in other estate planning documents. Further, if two joint owners transfer property by TOD deed, the transfer to the beneficiary is not effective until both joint owners pass away.

The property owner can revoke a TOD deed by a properly notarized and recorded document and make a new beneficiary designation on another TOD deed, providing more control than a deed reserving a life estate. It is important to note that a TOD deed cannot be revoked by a provision in a Will. Transfer on death allows for the avoidance of a probate or administration proceeding as to that asset, which could prevent the delay and expense of an estate proceeding and avoid a contested estate to the extent that particular assets already have ironclad beneficiaries. With all transfer on death designations, the property needs to be owned at death for the transfer to the beneficiary to be effective.

Deeds can also be used as an estate planning mechanism. For instance, a parent may transfer property by deed to a child and reserve a life estate. This means that the child owns the property immediately and that the parent has the right to live in the property for her lifetime. When the child wants to eventually sell the property to a third party, proof of death of the parent would need to be provided to indicate that the life estate has been extinguished. A drawback to a deed reserving a life estate is that if the parent and child become estranged and the parent regrets that the child owns the property, the child’s participation in signing a new deed transferring the property back to the parent would be required. A TOD deed avoids the problems inherent in a deed reserving a life estate, in that the property owner can revoke the TOD deed and otherwise retains control over the property.

Engaging an experienced attorney to draft a Trust and transferring the property to the Trust is another estate planning mechanism. That way, the property will be held by the person designated in the Trust after the property owner’s death and the Trust (assuming that it is revocable) can be amended during the property owner’s life to provide for another person to acquire the property after death, which provides more flexibility than the life estate option.

We expect that the use of TOD deeds in New York will cause a variety of legal issues to arise. Our attorneys will be available to address these upcoming matters.

New York Real Estate Lawyers Blog

New York Real Estate Lawyers Blog