Recently in the news is a story about a bagel store in the West Village neighborhood in Manhattan which became an “internet sensation” and its resulting popularity is causing problems with its landlord. It seems that, according to the landlord, the store has been unable, or unwilling, to accommodate the large crowds seeking its bagels, and this has created lines out in the sidewalk and street, which the landlord has claimed is a violation of its lease.

Recently in the news is a story about a bagel store in the West Village neighborhood in Manhattan which became an “internet sensation” and its resulting popularity is causing problems with its landlord. It seems that, according to the landlord, the store has been unable, or unwilling, to accommodate the large crowds seeking its bagels, and this has created lines out in the sidewalk and street, which the landlord has claimed is a violation of its lease.

The situation raises many legal questions, a discussion of which should be helpful to both commercial landlords and tenants who may find themselves in similar situations.

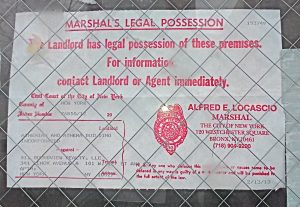

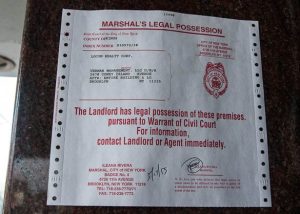

First, what happens in a legal sense once a landlord believes that a tenant is violating the terms of the lease? In general, most violations of a commercial lease will cause the landlord to issue a Notice to Cure. What this means is that the landlord, or their managing agent or attorney, will serve a Thirty Day Notice to Cure on the tenant. This document will formally notify the tenant that it is not in compliance with a material term of its lease, and that the tenant now has thirty days to cure the violation. In the case of Apollo Bagels, the landlord stated in its thirty-day notice that the lease was being violated in that business was being conducted outside of the premises, and that the lines of customers outside the store created a nuisance or unreasonable annoyance, another breach of the lease.

New York Real Estate Lawyers Blog

New York Real Estate Lawyers Blog