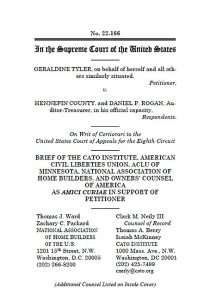

A prior blog post discussed a case now before the United States Supreme Court relating to surplus funds in tax lien foreclosures. The case involved a 94 year old woman in Minnesota who owed $2,300.00 in unpaid property taxes. The property was sold by the county for $40,000.00. The county then kept the excess funds from the sale, and, under the existing law, did not return the surplus funds to the former homeowner.

A prior blog post discussed a case now before the United States Supreme Court relating to surplus funds in tax lien foreclosures. The case involved a 94 year old woman in Minnesota who owed $2,300.00 in unpaid property taxes. The property was sold by the county for $40,000.00. The county then kept the excess funds from the sale, and, under the existing law, did not return the surplus funds to the former homeowner.

Several states, including New York, have similar laws. In New York State, if your property is sold to pay an overdue tax lien, any funds received from the sale belong to the government, and not to the person whose property was seized, even if they greatly exceed the amount owed in delinquent taxes.

The U.S. Supreme Court recently heard oral arguments on this case. During these arguments, Justice Elena Kagan asked, if the property was worth one million dollars, and the tax bill was only five dollars, would the county keep the excess funds? The attorney representing Hennepin County in Minnesota basically answered in the affirmative.

While this is an extreme example, it may show the factors that the Court is considering in deciding whether these laws may violate constitutional provisions against excessive fines, as well as the due process clause. If the Minnesota law is overturned as unconstitutional, such a ruling would affect similar laws in other states, such as New York.

A decision on this case is expected in late June. Our attorneys will continue to monitor and will update this blog when the decision is available. We will potentially be able to assist in the recovery of surplus funds in New York tax lien foreclosures should the Supreme Court rule accordingly.

New York Real Estate Lawyers Blog

New York Real Estate Lawyers Blog