Bagels With a Side of Injunction

Recently in the news is a story about a bagel store in the West Village neighborhood in Manhattan which became an “internet sensation” and its resulting popularity is causing problems with its landlord. It seems that, according to the landlord, the store has been unable, or unwilling, to accommodate the large crowds seeking its bagels, and this has created lines out in the sidewalk and street, which the landlord has claimed is a violation of its lease.

Recently in the news is a story about a bagel store in the West Village neighborhood in Manhattan which became an “internet sensation” and its resulting popularity is causing problems with its landlord. It seems that, according to the landlord, the store has been unable, or unwilling, to accommodate the large crowds seeking its bagels, and this has created lines out in the sidewalk and street, which the landlord has claimed is a violation of its lease.

The situation raises many legal questions, a discussion of which should be helpful to both commercial landlords and tenants who may find themselves in similar situations.

First, what happens in a legal sense once a landlord believes that a tenant is violating the terms of the lease? In general, most violations of a commercial lease will cause the landlord to issue a Notice to Cure. What this means is that the landlord, or their managing agent or attorney, will serve a Thirty Day Notice to Cure on the tenant. This document will formally notify the tenant that it is not in compliance with a material term of its lease, and that the tenant now has thirty days to cure the violation. In the case of Apollo Bagels, the landlord stated in its thirty-day notice that the lease was being violated in that business was being conducted outside of the premises, and that the lines of customers outside the store created a nuisance or unreasonable annoyance, another breach of the lease.

Partition Actions and Foreclosure

Our firm handles many partition matters. As discussed in prior blog posts, a partition action occurs when one (or more) co-owners of a property no longer wish to co-own the property. A partition action is a legal mechanism wherein a co-owner can petition the Court for an order to have the property sold, and the proceeds divided among the co-owners. Usually a Court-appointed Referee is responsible for selling the property, either through a public auction sale, or by hiring a real estate broker. The Referee will also determine, after hearing evidence submitted by the parties, exactly how the proceeds will be divided.

Our firm handles many partition matters. As discussed in prior blog posts, a partition action occurs when one (or more) co-owners of a property no longer wish to co-own the property. A partition action is a legal mechanism wherein a co-owner can petition the Court for an order to have the property sold, and the proceeds divided among the co-owners. Usually a Court-appointed Referee is responsible for selling the property, either through a public auction sale, or by hiring a real estate broker. The Referee will also determine, after hearing evidence submitted by the parties, exactly how the proceeds will be divided.

As the property at issue may be co-owned by several people, it is not always clear who is responsible for paying the carrying charges on the property, either before or during a partition action. For example, three siblings inherit a house after the death of their parents. They cannot agree on who should pay the mortgage and property taxes, and these obligations must be paid, regardless of the current dispute over the ownership.

Once this occurs, there may be a foreclosure action brought by the mortgage holder. All of the c0-owners would be named as defendants in such an action. In addition, if the property taxes are not paid by any of the co-owners, and the mortgage remains unpaid, the property taxes may be in arrears. In this situation, the entity to whom the taxes are owed may obtain a tax lien against the property. Often, these liens are then sold to a third party. This third party may then commence a tax lien foreclosure action against the property, and name all the co-owners as defendants in that action.

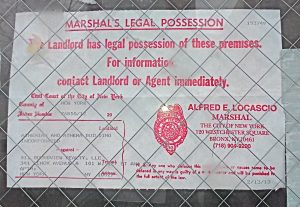

Eviction Action or Ejectment Action?

Our firm is involved in many situations in which one party seeks to remove another party from property, such as a house, cooperative, or condominium unit. However, the situation underlying the attempted removal will often determine the correct legal method for effectuating said removal.

Our firm is involved in many situations in which one party seeks to remove another party from property, such as a house, cooperative, or condominium unit. However, the situation underlying the attempted removal will often determine the correct legal method for effectuating said removal.

The two main legal remedies are an eviction action and an ejectment action. Keep in mind that there may be situations in which an experienced attorney needs to use his legal judgment to determine which type of action to bring. First, we will cover an eviction action.

Eviction actions are generally used in ordinary landlord-tenant matters. In most cases, there is a tenant who is renting property from the property owner, who is the landlord. There usually is a written lease, but not in all situations. There are generally two types of eviction actions. The first is a non-payment, in which the tenant has failed to pay her rent. The second is a holdover, in which the tenant’s lease has expired, or a situation in which the tenant never had a lease and has a month-to-month tenancy.

Legal Issues Raised by the Death of Pete Rose

Baseball fans learned of the recent passing of Pete Rose a/k/a “Charlie Hustle.” Rose was most closely identified by his championship playing days for the “Big Red Machine” Cincinnati Reds. He was a divisive figure in that he was known as the Hit King for having the most hits of any baseball player as well as other achievements that would have clearly allowed for his election to baseball’s Hall of Fame. He was permanently banned from baseball and excluded from Hall of Fame ballots for gambling on the outcome of baseball games. This post will address the legal issues raised by Mr. Rose’s death.

Baseball fans learned of the recent passing of Pete Rose a/k/a “Charlie Hustle.” Rose was most closely identified by his championship playing days for the “Big Red Machine” Cincinnati Reds. He was a divisive figure in that he was known as the Hit King for having the most hits of any baseball player as well as other achievements that would have clearly allowed for his election to baseball’s Hall of Fame. He was permanently banned from baseball and excluded from Hall of Fame ballots for gambling on the outcome of baseball games. This post will address the legal issues raised by Mr. Rose’s death.

The pride of Cincinnati also led a colorful personal life. He was married and divorced twice and had a girlfriend at the time of death. Since he was not married at the time of his death, his girlfriend would not stand to inherit from his estate unless he had a Will and left assets to her. Rose had several children from his marriages. He may have potentially fathered other children from his illicit romantic affairs, some of which may have been conducted with underage girls. If Rose did not have a Will, his children (marital or not) would inherit his estate.

Once Rose was banned from baseball, he made a living largely through the sports memorabilia business. He sold autographed baseballs and other items to his remaining fans. The memorabilia that he amassed and kept from his playing days would potentially add significant value to his estate. His estate fiduciary would need to determine the best means by which to dispose of such valuable personal property, unless Rose had a Will providing for direction for its disposition.

Legal Issues Relating to the Sale of Inherited Property

Our firm has often been consulted by clients who inherited a house from their parents, and wish to sell the property, as they may have moved out-of-state, and the property became vacant after the passing of the last parent.

Our firm has often been consulted by clients who inherited a house from their parents, and wish to sell the property, as they may have moved out-of-state, and the property became vacant after the passing of the last parent.

Usually, this is a straightforward transaction, which often requires legal assistance in acquiring legal authority to sell the property as part of an estate. This involves experienced counsel filing for letters testamentary (if there is a will) or letters of administration (if there is no will). Once the Surrogate’s Court issues the proper legal document, then the sale can proceed.

However, there is often another issue, which may become known to the surviving children only after their parents’ death. It is possible that the parents borrowed against the property, even after the original mortgage that they took out to purchase the premises was paid off. Often a reverse mortgage is taken out by the elderly parents, in order to raise funds to continue to live in the house. Generally, such mortgages are only available to homeowners over the age of 62. Once the loan funds are disbursed, there are no monthly payments. The full amount of the loan would then be due after the death of the last borrower.

Considerations When Making a Will as to Potential Property Sharing by Heirs

Clients consulting our firm with respect to will drafting often ask how to leave a house or cooperative apartment to potential heirs when there may be more than one surviving child. Perhaps a person owns a house and wants to leave it to all three of her children in her Will. Concerns arise when one of the children has been living in the house all of his life or only one of the children frequently enjoys the use of the house as a vacation home. In either case, the remaining children have no use for the property. The well-intentioned parent may be inadvertently causing a family dispute after her death. If the child who wants the property does not have the financial ability to buy out his siblings, by mortgage financing or otherwise, the remaining siblings may have no choice except for engaging an experienced attorney to commence a partition action.

The person making the Will also needs to determine whether she wishes for her children to inherit in equal portions. For example, if the house is of particular interest to one child and there are other assets available to be distributed to the other children, the parent may decide to leave the other assets to the other children, so that each child receives substantially similar disbursements.

We have reviewed documents prepared by others providing that a person can continue to reside in the house until a particular triggering event such as vacating the house or death, after such event those who will inherit the property can have full access and sell it if they wish. Such a document may provide that the occupant pay the property expenses while occupying. This arrangement is not one that we recommend because it delays the delivery of the asset to the intended owner(s) and the occupant may not meet property upkeep demands, which provisions are difficult to enforce.

When is a Lease Renewal Not a Lease Renewal?

Our firm often receives inquires regarding renewals of residential leases. As prior blog posts have discussed, in general, a tenant in New York has no legal right to an automatic renewal lease, unless the rental unit is subject to some type of rent regulation. Another exception may be where the lease itself contains a clause that allows either party to renew the lease upon proper notice to the other party. The notice period may be 30 or 60 days (or even a longer time length) prior to the current lease expiration, so it is important for experienced counsel to review residential leases to ensure that, if a party wishes to renew, proper notice is timely sent to the other party under the lease terms.

However, it is also possible that the renewal clause itself may contain language which makes it unenforceable under New York law. The main example of this situation is where the “renewal” language is insufficiently specific as to the terms of a possible renewal. In general, a renewal clause must contain fairly exact terms as to the renewal lease term, as well as the amount of monthly rent to be paid under a renewal.

For example, if the renewal clause states that the tenant may renew this lease for an additional one year term at the same rent as the current lease, this would be enforceable, assuming that the tenant gives the proper notice as delineated in the lease for a renewal. Another enforceable example would be if the clause states that the lease can be renewed for an additional one year term at a 5% rent increase.