Pope Francis’ first visit to the United States has managed to inspire numerous people. Yesterday’s speech before Congress mesmerized all of those in attendance, regardless of their religious or political affiliation. The Pope’s message has been unifying to all witnesses, which is why many people have been so excited by his visit, even though many of us are not Catholic and may not agree with his specific positions.

Pope Francis’ first visit to the United States has managed to inspire numerous people. Yesterday’s speech before Congress mesmerized all of those in attendance, regardless of their religious or political affiliation. The Pope’s message has been unifying to all witnesses, which is why many people have been so excited by his visit, even though many of us are not Catholic and may not agree with his specific positions.

What happens when a religious leader is divisive instead? This post will examine the legal ramifications when the leader of a religious institution is the source of conflict among congregants. It is not unusual for clients to consult us concerning disputes within their religious institutions.

In the event that the congregants choose to continue to worship together under the leadership of another clerical leader, steps may need to be taken to legally terminate the relationship with the spiritual leader. As we discussed in a prior post , the spiritual leader may be classified as an independent contractor or employee, depending upon the circumstances. An independent contractor may be dismissed more readily.

The political season is well under way. Given that our country’s next presidential election is about 14 months away, we see more and more politicians gearing up for a run for our nation’s highest office. Another well-worn aspect of such political events is the use of a popular song by the politician during a rally.

The political season is well under way. Given that our country’s next presidential election is about 14 months away, we see more and more politicians gearing up for a run for our nation’s highest office. Another well-worn aspect of such political events is the use of a popular song by the politician during a rally.

As we enter the last days of summer,

As we enter the last days of summer, It is not unusual for the estate of a deceased person to hold stock as an asset. Stock can take the form of shares held in a publically traded company, such as Target, or shares in a cooperative corporation. Clients often ask

It is not unusual for the estate of a deceased person to hold stock as an asset. Stock can take the form of shares held in a publically traded company, such as Target, or shares in a cooperative corporation. Clients often ask

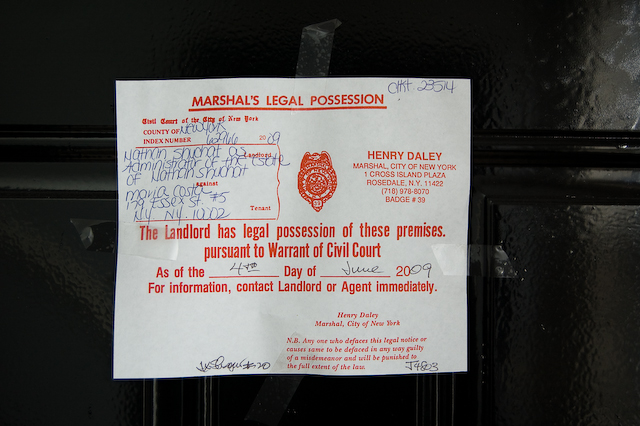

Many of our clients are landlords who own only one property, such as a single or multi-family house or an apartment. Although they may be renting to a tenant, it is not their primary business or livelihood. As such,

Many of our clients are landlords who own only one property, such as a single or multi-family house or an apartment. Although they may be renting to a tenant, it is not their primary business or livelihood. As such,

A recent

A recent