Recently in the news is the rather gruesome story of a woman who was murdered and dismembered. Her body parts were discovered in Nassau and Suffolk Counties. Her neighbor was arrested for her murder and is being held without bail. According to the news story, the root of the conflict between the two women appears to have been a landlord-tenant dispute.

Recently in the news is the rather gruesome story of a woman who was murdered and dismembered. Her body parts were discovered in Nassau and Suffolk Counties. Her neighbor was arrested for her murder and is being held without bail. According to the news story, the root of the conflict between the two women appears to have been a landlord-tenant dispute.

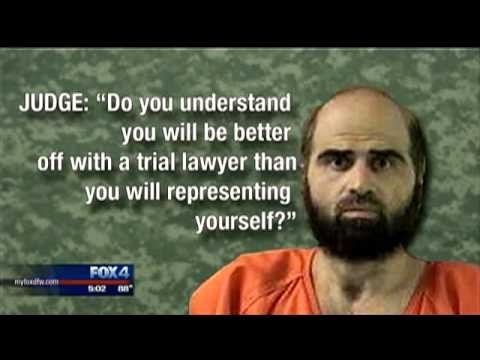

The accused murderer, Leah Cuevas, was pretending to be the landlord of the building in which the two women lived, after the actual owner passed away. Ms. Cuevas then attempted to collect the rent from the building’s tenants, and when fellow tenant Chinelle LaToya Thompson Browne refused to pay, she was allegedly murdered by Ms. Cuevas. Of course, most landlord-tenant conflicts do not end in this manner. This blog post will attempt to discuss the legal issues involved, although, as our firm does not generally practice criminal law, we will leave the more graphic issues to the criminal courts.

Often, a situation can arise where a person claims to be the owner and/or landlord of a house or apartment building and demands rent from the tenants. This can happen where the original landlord passes away without a will, or where the building is being foreclosed by a lender. There may be occurrences where a landlord cannot meet the carrying charges on a building, such as the mortgage and utilities, and simply “walks away” from their ownership. If the ownership is in a corporate name, the landlord may not be personally liable for the building’s debts, and does not dispute any foreclosure proceeding that may occur.

A recent

A recent  A recent article in the

A recent article in the

Recently in the news is a

Recently in the news is a  In a

In a  Memorial Day weekend is eagerly anticipated by many of our readers, especially this year after the harsh winter that we endured. Fortunate travelers expect to enjoy their vacation homes this weekend. As you head out for the weekend,

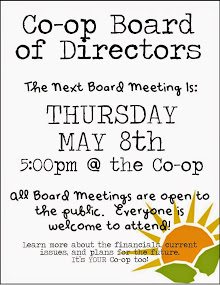

Memorial Day weekend is eagerly anticipated by many of our readers, especially this year after the harsh winter that we endured. Fortunate travelers expect to enjoy their vacation homes this weekend. As you head out for the weekend,  May and June of each year tend to be “annual meeting season” for our cooperative and condominium clients. At such meetings, the shareholders of cooperatives and unit owners of condominiums elect their board of directors or board of managers. Those who serve on boards are hard working volunteers, participating on a weekly if not daily basis. Those who attend annual meetings may only attend one meeting a year to question and judge those who participate on their behalf on a constant basis. This blog post will address how to properly conduct annual meetings and why smoothly run annual meetings are important. Although our law firm also conducts annual meetings for condominiums and religious corporations, this post will be limited to cooperative corporation annual meetings.

May and June of each year tend to be “annual meeting season” for our cooperative and condominium clients. At such meetings, the shareholders of cooperatives and unit owners of condominiums elect their board of directors or board of managers. Those who serve on boards are hard working volunteers, participating on a weekly if not daily basis. Those who attend annual meetings may only attend one meeting a year to question and judge those who participate on their behalf on a constant basis. This blog post will address how to properly conduct annual meetings and why smoothly run annual meetings are important. Although our law firm also conducts annual meetings for condominiums and religious corporations, this post will be limited to cooperative corporation annual meetings. it merely needs to hold its meetings at regular intervals each year. The By-Laws specify that the notice of annual meeting is to state that the business to be conducted is to elect directors and to conduct other business specifically identified in the notice, should state the time, date and place of the meeting, and who needs to sign the meeting notice.

it merely needs to hold its meetings at regular intervals each year. The By-Laws specify that the notice of annual meeting is to state that the business to be conducted is to elect directors and to conduct other business specifically identified in the notice, should state the time, date and place of the meeting, and who needs to sign the meeting notice.  New Yorkers seem to be “taxed to death”, paying the highest average property taxes in the country. We are the only state that charges a tax for the making of a mortgage. The tax burden does not end at death, as New York also has its own estate tax. Governor Andrew Cuomo, seeking re-election this year, has been encouraging the state legislature to reduce these burdens.

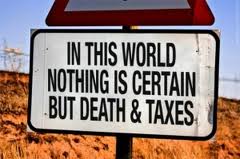

New Yorkers seem to be “taxed to death”, paying the highest average property taxes in the country. We are the only state that charges a tax for the making of a mortgage. The tax burden does not end at death, as New York also has its own estate tax. Governor Andrew Cuomo, seeking re-election this year, has been encouraging the state legislature to reduce these burdens.