Maurice Sendak was a beloved children’s book author and illustrator whose death two years ago has raised multiple issues to be discussed in this blog post. During his life, he had a close professional affiliation with the Rosenbach Museum and Library in Philadelphia, whereby he lent a vast majority of his books and illustrations for viewing by the general public. He also had a caretaker who managed his personal affairs for decades and was very knowledgeable about his preferences. Mr. Sendak’s Will provided that his caretaker would be one of three executors. It also left some valuable original book manuscripts to the Rosenbach and established a foundation. It was his expressed wish in the Will that the foundation retrieve the works that were on loan to the Rosenbach and display them in the house in which he lived for many decades. The house was to be developed as a study center. We have written another blog post concerning stipulations on bequests that is reminiscent of this situation. After his death, the three executors sought to retrieve the works on loan to the Rosenbach in accordance with Mr. Sendak’s wishes. The Rosenbach objected and commenced litigation against the estate on several grounds to be discussed.

Maurice Sendak was a beloved children’s book author and illustrator whose death two years ago has raised multiple issues to be discussed in this blog post. During his life, he had a close professional affiliation with the Rosenbach Museum and Library in Philadelphia, whereby he lent a vast majority of his books and illustrations for viewing by the general public. He also had a caretaker who managed his personal affairs for decades and was very knowledgeable about his preferences. Mr. Sendak’s Will provided that his caretaker would be one of three executors. It also left some valuable original book manuscripts to the Rosenbach and established a foundation. It was his expressed wish in the Will that the foundation retrieve the works that were on loan to the Rosenbach and display them in the house in which he lived for many decades. The house was to be developed as a study center. We have written another blog post concerning stipulations on bequests that is reminiscent of this situation. After his death, the three executors sought to retrieve the works on loan to the Rosenbach in accordance with Mr. Sendak’s wishes. The Rosenbach objected and commenced litigation against the estate on several grounds to be discussed.

The Rosenbach’s attorneys objected to the caretaker serving as executor. Mr. Sendak had the foresight to appoint two other people to serve jointly as executor, although this was not legally necessary. Testators have wide latitude in the appointment of executors. Generally, even an estate beneficiary does not have cause to object to the testator’s designation of executor. Although some executors may have had a “confidential relationship” with the deceased, such as a clergyman or doctor, a confidential relationship does not on its own disqualify an executor. In this instance, the caretaker had a long standing relationship with the deceased, making her a natural choice to serve. Another objection was that she was unsophisticated in business matters and not suited to her position. In having two other individuals serve jointly, Mr. Sendak may have considered that the caretaker was best to dispose of works due to her personal knowledge while the other executors may have been better suited to the business matters to be confronted by the estate.

Although these factors do not seem to be present in this case, executors can be disqualified for particular reasons. Executors are fiduciaries who owe a duty to preserve estate assets and not engage in self-dealing. For instance, if the caretaker was found to have taken the artwork for her own use and sale for her own benefit, estate beneficiaries could approach the Court and make a formal legal request for her removal as executor. Further, an accounting procedure could be commenced to require the executor to demonstrate the proper collection and disbursement of estate assets.

New York Real Estate Lawyers Blog

New York Real Estate Lawyers Blog

Even Halloween gives rise to legal issues that may pertain to our blog readers. This blog post will address haunted houses, zombie houses, ghosts and other scary situations from a legal perspective.

Even Halloween gives rise to legal issues that may pertain to our blog readers. This blog post will address haunted houses, zombie houses, ghosts and other scary situations from a legal perspective. People are leading increasingly complicated lives, in that they spend their time in several locales, some of which may not be their place of residence. If a person is fortunate, they may develop an affection for a particular area and buy a second home in such area. Likewise, they may inherit a beloved family home in a location where they do not live. When such a person passes away, the disposition of all of their property, no matter where located, must be addressed. The question to be explored in this blog post is which Court has jurisdiction over which property.

People are leading increasingly complicated lives, in that they spend their time in several locales, some of which may not be their place of residence. If a person is fortunate, they may develop an affection for a particular area and buy a second home in such area. Likewise, they may inherit a beloved family home in a location where they do not live. When such a person passes away, the disposition of all of their property, no matter where located, must be addressed. The question to be explored in this blog post is which Court has jurisdiction over which property.  Evil stepmothers are not only found in popular culture, as epitomized in Cinderella

Evil stepmothers are not only found in popular culture, as epitomized in Cinderella  . Such persons are commonly the subject of events reported by the New York press.

. Such persons are commonly the subject of events reported by the New York press.  Memorial Day weekend is eagerly anticipated by many of our readers, especially this year after the harsh winter that we endured. Fortunate travelers expect to enjoy their vacation homes this weekend. As you head out for the weekend,

Memorial Day weekend is eagerly anticipated by many of our readers, especially this year after the harsh winter that we endured. Fortunate travelers expect to enjoy their vacation homes this weekend. As you head out for the weekend,  New Yorkers seem to be “taxed to death”, paying the highest average property taxes in the country. We are the only state that charges a tax for the making of a mortgage. The tax burden does not end at death, as New York also has its own estate tax. Governor Andrew Cuomo, seeking re-election this year, has been encouraging the state legislature to reduce these burdens.

New Yorkers seem to be “taxed to death”, paying the highest average property taxes in the country. We are the only state that charges a tax for the making of a mortgage. The tax burden does not end at death, as New York also has its own estate tax. Governor Andrew Cuomo, seeking re-election this year, has been encouraging the state legislature to reduce these burdens.

The Associated Press recently reported about a

The Associated Press recently reported about a  In

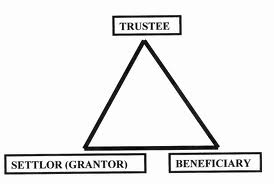

In  Trusts provide a valuable tool in estate planning because they serve the purposes of preserving assets, protecting intended beneficiaries, and potentially saving or eliminating estate taxes. A trust is a legal document that conveys a “corpus”, or body of assets, from the settlor (the person who creates the trust and owns to assets) to a trustee (the individual or corporate entity with the responsibility of holding the assets) for the benefit of the beneficiary (the person who will ultimately receive the proceeds of the trust). A charitable organization may also be the beneficiary of a trust.

Trusts provide a valuable tool in estate planning because they serve the purposes of preserving assets, protecting intended beneficiaries, and potentially saving or eliminating estate taxes. A trust is a legal document that conveys a “corpus”, or body of assets, from the settlor (the person who creates the trust and owns to assets) to a trustee (the individual or corporate entity with the responsibility of holding the assets) for the benefit of the beneficiary (the person who will ultimately receive the proceeds of the trust). A charitable organization may also be the beneficiary of a trust.