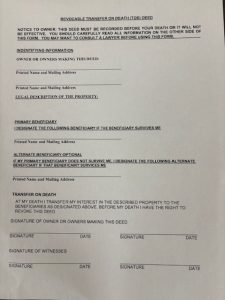

Breaking News: “Transfer on Death” Deeds Become Option in New York

We would like to inform our readers that Transfer on Death Deeds (“TOD”) will become an option for property transfers in New York as of July 19, 2024. Real property such as a house, condominium unit or vacant land is currently transferred by deed. There are currently various types of deeds available for property transfers in New York State. A Referee’s Deed applies to the transfer of property by the Court appointed Referee after a foreclosure sale. An Administrator’s or Executor’s Deed is used by the fiduciary appointed by the Surrogate’s Court in an estate matter to transfer property to the proper person designated by the Will or who is entitled to the property according to intestacy. A seller in a standard real estate transaction will deliver a deed based on the level of quality of title promised to the buyer. Such deeds may be either a quitclaim or warranty deed, or a bargain and sale deed with or without covenants.

Our readers may be familiar with transfer on death designations on bank accounts whereby the account will automatically go to the designee upon the account owner’s death. Changes to the beneficiary can also be made during the account owner’s lifetime. TOD deeds will operate in much the same fashion. Such deeds will need to be signed before two witnesses and notarized before they are recorded before the owner’s death in the clerk’s office in the county in which the property is located. Similar to the standards in making a Will, the property owner needs to have capacity, not be under fraud or duress, or unduly influenced. The property owner retains control over the property and can sell or encumber the property with a mortgage. The designee of the property takes it subject to any liens or mortgages to which the property is subject at the property owner’s death. The transfer lapses if the beneficiary does not survive the owner, so it is necessary to provide for such a potential event by designating an alternate beneficiary in the TOD deed or by having a qualified attorney provide for such an occurrence in other estate planning documents. Further, if two joint owners transfer property by TOD deed, the transfer to the beneficiary is not effective until both joint owners pass away.

The property owner can revoke a TOD deed by a properly notarized and recorded document and make a new beneficiary designation on another TOD deed, providing more control than a deed reserving a life estate. It is important to note that a TOD deed cannot be revoked by a provision in a Will. Transfer on death allows for the avoidance of a probate or administration proceeding as to that asset, which could prevent the delay and expense of an estate proceeding and avoid a contested estate to the extent that particular assets already have ironclad beneficiaries. With all transfer on death designations, the property needs to be owned at death for the transfer to the beneficiary to be effective.

New York Eviction Law – Anti-Squatter Law Passed

Recently in the news are stories about squatters taking over properties in New York. A recent blog post addressed the question of who is legally defined as a squatter, and how such a person could be evicted. The reason for this prior analysis is that, under then-current New York law, anyone occupying a property for at least thirty days was legally considered a “tenant” and had to be evicted through the Court system, most often in the local landlord-tenant Court.

Recently in the news are stories about squatters taking over properties in New York. A recent blog post addressed the question of who is legally defined as a squatter, and how such a person could be evicted. The reason for this prior analysis is that, under then-current New York law, anyone occupying a property for at least thirty days was legally considered a “tenant” and had to be evicted through the Court system, most often in the local landlord-tenant Court.

Allowing such persons the same protections under the law as actual tenants (generally meaning those who had a lease and were paying rent to the owner) caused property owners serious problems. Under the prior law, a person could enter the premises without the consent of the owner, remain there for at least thirty days, and be considered a tenant for the purposes of eviction law. The owner would then have to hire experienced counsel to first issue a termination notice to the “tenant” who entered the property without his consent. After the expiration of the termination notice, if the occupant failed to vacate, an action in landlord-tenant Court would have to be commenced. Such an action, under the law, requires approximately two weeks prior notice to the “tenant.” Once in Court, a tenant is allowed an adjournment to obtain counsel if requested. Further adjournments, depending on the Court’s caseload, would be likely. As a result, the “tenant,” who entered without the owner’s consent, and was not paying rent to the owner, could stay for quite some time before the Court finally allowed an eviction to occur. The expenses of such legal proceedings, as well as the actual eviction conducted by the Marshal, would have to be paid by the owner, with little chance of recovering such sums from the squatter.

In light of these unjust outcomes, New York has now passed a new law that excludes squatters from the protections of the landlord-tenant laws. The law now defines a squatter as someone staying at a property without permission from the owner or a representative for the owner. It states that a squatter is not to be considered a tenant, and is not entitled to the legal protections of a tenant. As a result, if someone is illegally occupying property, the owner can contact the police to remove the squatter, rather than having to evict him through the Court system.

The Day Has Come: Amended Property Condition Disclosure Law Becomes Effective

We have previously posted concerning a significant amendment to the property condition disclosure law in New York. Previously, sellers of residential real estate were required to complete a detailed questionnaire concerning property conditions or issue a $500 credit at the closing for failure to deliver the document. Many sellers, especially those in  downstate NY, as serviced by our firm, preferred to issue the $500 credit instead of completing the form.

downstate NY, as serviced by our firm, preferred to issue the $500 credit instead of completing the form.

The new law, which becomes effective on March 20, eliminates the seller’s option to issue the $500 credit. Instead, it requires the completion and delivery of the form to the buyer before the contract is signed. Further, it contains more extensive information concerning flood risks and history and whether the property has been insured against flood risk. This author suggests that the amendment was motivated by devastating floods and water damage that have affected some home buyers in recent years, with the main goal being disclosure of flooding. The legislature went further than adding flooding disclosures and moved towards requiring full disclosure by the seller.

It remains to be seen how real estate professionals will handle the amended law. Although sellers are expected to complete the form, real estate agents may end up providing assistance. It may be preferable that sellers have the completed form ready at the same time that the accepted offer is provided to the seller’s attorney, who will prepare and deliver the proposed contract to the buyer’s attorney, so as not to delay the process of obtaining signed contracts as soon as possible. Otherwise, sellers may lean on their attorneys for advice in completing the form.

New York Eviction Law – Who is a Squatter?

Recently in the news is a story about a couple who purchased a house in Queens after foreclosure. After they completed their purchase, they discovered a “squatter” living in the house. This story raises the question of who is legally defined as a squatter, and how can such a person be evicted?

Recently in the news is a story about a couple who purchased a house in Queens after foreclosure. After they completed their purchase, they discovered a “squatter” living in the house. This story raises the question of who is legally defined as a squatter, and how can such a person be evicted?

First, let it be said that this is by no means an unusual course of events in New York. New York State laws, as well as many Judges in the landlord-tenant Courts, are notoriously “pro-tenant,” making it difficult to evict anyone, even squatters. Changes in New York Real Property Actions and Proceedings Law, which governs eviction procedure, have made it even more difficult to complete an eviction process. Even in situations in which the tenant has already been evicted, the tenant in many cases may seek a temporary injunction to allow him to move back into the premises, even if the eviction was done completely and lawfully.

The “squatter” in the Queens case turned out to be a handyman who claimed that the former owner of the premises gave him permission to reside at the premises. This moves him out of the category of squatter, as a squatter under the law is an individual who was never given consent, by any owner or former owner, to reside at the premises. Under the law, the handyman would be considered an alleged “licensee.” A licensee is someone who was allowed to live at the property by the owner without a lease or payment of rent, such as a girlfriend or boyfriend of the owner, or in this case, a handyman who claims to have permission from the former owner.

Lengthy Delays in Landlord-Tenant Proceedings – Will a Lawsuit Help?

A recent case was filed in Supreme Court, Queens County by a group of corporations under the umbrella of the LeFrak Organization – one of the largest landlords in Queens. The lawsuit was brought as an Article 78 proceeding. An Article 78 proceeding is a lawsuit brought against a New York State official, or New York administrative agency, in which the plaintiff seeks to overturn a decision made by the official or agency on the grounds that it violated New York law.

A recent case was filed in Supreme Court, Queens County by a group of corporations under the umbrella of the LeFrak Organization – one of the largest landlords in Queens. The lawsuit was brought as an Article 78 proceeding. An Article 78 proceeding is a lawsuit brought against a New York State official, or New York administrative agency, in which the plaintiff seeks to overturn a decision made by the official or agency on the grounds that it violated New York law.

The plaintiffs in this action seek reform of the handling of housing court cases in Queens County, in which long delays have been the rule, rather than the exception. New York housing courts have jurisdiction over eviction cases, which can be brought as summary proceedings. As the name “summary proceedings” suggests, these cases are meant to be brought in an expedited matter, and are supposed to be heard and resolved more quickly than actions brought in New York Supreme Court.

Under current New York law, housing court cases are required to be scheduled by the Court for an appearance in Court between three and eight days after a tenant responds to an eviction petition. If the tenant fails to respond, or fails to appear on the return date, the landlord-tenant court is supposed to issue a warrant of eviction, as well as a judgment in favor of the landlord.

Is there a Doctor in the Property?

We have represented both landlords and tenants with respect to commercial leases. This post will examine the particulars to be considered when a doctor or medical practice is the tenant.

When evaluating a potential location, the proposed tenant should first determine whether the space is compliant with the Americans with Disabilities Act (“ADA”). For instance, if the building has steps to its front entrance, is a ramp also installed to allow for wheelchair access? Is there an elevator and if so, is it also suitable to be used by patients with wheelchairs. Do the restroom facilities comply with ADA?

In the event that the space is not ADA compliant or requires adjustments to be suited for the installation of medical equipment, the parties may decide that the space will be built out before the tenant occupies. The parties will decide which one of them will be responsible for the build out costs and whether the tenant will be afforded a rent concession until such time as the space is completely constructed and ready for use, provided that the tenant exercises diligence in completing the construction, in accordance with building permits to be obtained and without the attachment of mechanics liens to the property.