The New York Times recently published an article concerning the scenario that many New Yorkers fear. Having lost personal and professional connections to relatives and friends, some people unfortunately die alone. Since these people are not missed, days or weeks could go by before odors emanate from their home and uncollected mail piles up, resulting in a neighbor’s notification to the police about a suspected death. The police discover a corpse, which starts the legal matters to be addressed in this post.

The New York Times recently published an article concerning the scenario that many New Yorkers fear. Having lost personal and professional connections to relatives and friends, some people unfortunately die alone. Since these people are not missed, days or weeks could go by before odors emanate from their home and uncollected mail piles up, resulting in a neighbor’s notification to the police about a suspected death. The police discover a corpse, which starts the legal matters to be addressed in this post.

These lonely people may very likely have mental issues such as compulsive hoarding. Perhaps the embarrassment of the condition of their home led these people to stop inviting people over, leading to additional isolation. The items will need to be removed in order to surrender an apartment to a landlord or to sell the home. Care is to be taken with respect to valuable items, being mindful of the need to deliver such items to the proper beneficiary, if such person is located.

It remains to be determined whether the deceased person had a Will, which may have been left in the personal possessions in the home. If there was a Will, the proposed fiduciaries need to be located so that a Probate Proceeding may be commenced in Surrogate’s Court. However, if a Will cannot be located, an estate Administration proceeding is to be conducted. We have indicated in a prior post tasks to be conducted by an estate administrator. Our readers may also wish to consult one of our prior posts concerning the mechanics of an Administration proceeding.

New York Real Estate Lawyers Blog

New York Real Estate Lawyers Blog

It is not unusual for the estate of a deceased person to hold stock as an asset. Stock can take the form of shares held in a publically traded company, such as Target, or shares in a cooperative corporation. Clients often ask

It is not unusual for the estate of a deceased person to hold stock as an asset. Stock can take the form of shares held in a publically traded company, such as Target, or shares in a cooperative corporation. Clients often ask  After another harsh winter in New York, many of us are looking forward to getting away this Memorial Day weekend. Those of us who are driving may have acquired the vehicle from an estate. This post will address

After another harsh winter in New York, many of us are looking forward to getting away this Memorial Day weekend. Those of us who are driving may have acquired the vehicle from an estate. This post will address  In the New York metropolitan area, the residential real estate market is often seasonal. During the holidays between Thanksgiving and New Years Day, most sellers do not list their properties for sale or may remove their home from active listing status. During the winter months, most buyers are reluctant to be exposed to the cold weather and the snow to view properties. Fortunately, all of this changes with the approach of spring. The inventory of homes increases as more properties are listed and additional purchasers are looking to enter transactions. Both parties to transactions, who will experience increased competition as inventory increases, should take the steps described in this post so as not to miss the spring season.

In the New York metropolitan area, the residential real estate market is often seasonal. During the holidays between Thanksgiving and New Years Day, most sellers do not list their properties for sale or may remove their home from active listing status. During the winter months, most buyers are reluctant to be exposed to the cold weather and the snow to view properties. Fortunately, all of this changes with the approach of spring. The inventory of homes increases as more properties are listed and additional purchasers are looking to enter transactions. Both parties to transactions, who will experience increased competition as inventory increases, should take the steps described in this post so as not to miss the spring season. Many people who pass away also leave behind the place in which they resided. The housing could be a rental apartment, a cooperative or condominium unit, or a house. The deceased may not necessarily have resided in the property immediately before death if they went to assisted living or a nursing home. This blog post will address the legal and practical matters arising from housing of the deceased.

Many people who pass away also leave behind the place in which they resided. The housing could be a rental apartment, a cooperative or condominium unit, or a house. The deceased may not necessarily have resided in the property immediately before death if they went to assisted living or a nursing home. This blog post will address the legal and practical matters arising from housing of the deceased. Every person who dies, whether wealthy or not, will owe money. Whether there is a credit card balance outstanding or estate taxes due to the State of New York, most people will leave this world with a financial obligation of some type. The questions to be addressed in this blog post involve how the fiduciary of the estate should address such debts and whether the fiduciary is personally responsible for the debts. Also, should debts of the deceased be deducted from estate proceeds before distribution to beneficiaries?

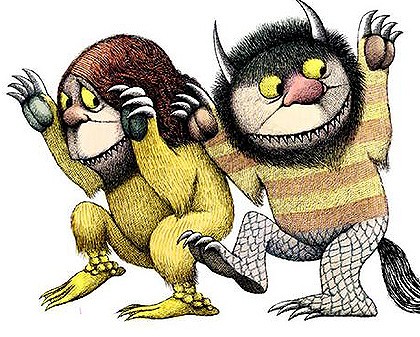

Every person who dies, whether wealthy or not, will owe money. Whether there is a credit card balance outstanding or estate taxes due to the State of New York, most people will leave this world with a financial obligation of some type. The questions to be addressed in this blog post involve how the fiduciary of the estate should address such debts and whether the fiduciary is personally responsible for the debts. Also, should debts of the deceased be deducted from estate proceeds before distribution to beneficiaries? Maurice Sendak was a beloved children’s book author and illustrator whose death two years ago has

Maurice Sendak was a beloved children’s book author and illustrator whose death two years ago has Even Halloween gives rise to legal issues that may pertain to our blog readers. This blog post will address haunted houses, zombie houses, ghosts and other scary situations from a legal perspective.

Even Halloween gives rise to legal issues that may pertain to our blog readers. This blog post will address haunted houses, zombie houses, ghosts and other scary situations from a legal perspective. People are leading increasingly complicated lives, in that they spend their time in several locales, some of which may not be their place of residence. If a person is fortunate, they may develop an affection for a particular area and buy a second home in such area. Likewise, they may inherit a beloved family home in a location where they do not live. When such a person passes away, the disposition of all of their property, no matter where located, must be addressed. The question to be explored in this blog post is which Court has jurisdiction over which property.

People are leading increasingly complicated lives, in that they spend their time in several locales, some of which may not be their place of residence. If a person is fortunate, they may develop an affection for a particular area and buy a second home in such area. Likewise, they may inherit a beloved family home in a location where they do not live. When such a person passes away, the disposition of all of their property, no matter where located, must be addressed. The question to be explored in this blog post is which Court has jurisdiction over which property.  Evil stepmothers are not only found in popular culture, as epitomized in Cinderella

Evil stepmothers are not only found in popular culture, as epitomized in Cinderella  . Such persons are commonly the subject of events reported by the New York press.

. Such persons are commonly the subject of events reported by the New York press.