Many of our readers are about to celebrate Rosh Hashanah. We wish those who observe a happy and healthy new year. At this time of year, those of the Jewish faith tend to reflect upon their acts during the past year and to set goals for improvements in the following year. Attorneys can provide the opportunity for one’s religious, moral and ethical values to be reflected in a final legacy, such as a Will or Trust. This post will discuss the means by which your attorney will insure that your values are properly contained within your estate documents.

Many of our readers are about to celebrate Rosh Hashanah. We wish those who observe a happy and healthy new year. At this time of year, those of the Jewish faith tend to reflect upon their acts during the past year and to set goals for improvements in the following year. Attorneys can provide the opportunity for one’s religious, moral and ethical values to be reflected in a final legacy, such as a Will or Trust. This post will discuss the means by which your attorney will insure that your values are properly contained within your estate documents.

Primarily, we suggest that you meet with a skilled professional , who is prepared to discuss your ethical values. The meeting should not only address the standard discussion of who should serve as fiduciaries (those named in the Will to act on behalf of the estate such as executors, trustees and guardians) and who should inherit your assets. For instance, a couple with minor children typically needs to determine who will serve as guardians to raise their children if they pass away. If religion is important to such a couple, they may want to appoint someone of the same religious background who will be instructed to continue the religious instruction and ritual observance to which the children have been accustomed. It is possible that a separate fiduciary may need to be named to handle financial matters for the children when a religiously sensitive guardian has been selected.

Discussions should be undertaken as to the distribution of assets. Authorizing a trust to distribute assets for religious education and travel, in addition to the standard education expenses, may be appropriate. Charitable matters should also be considered. If charitable giving is an important value to the client, we discuss the means by which charitable giving can be accomplished. Gifts made during lifetime typically have less significant tax consequences and the donor may be recognized personally for the contribution. However, the donor may need the assets during her lifetime and would rather part with them at a later time. Charitable trusts can also be established if appropriate. Our firm commonly coordinates with various organizations that are prepared to assist in the establishment of such charitable trusts.

New York Real Estate Lawyers Blog

New York Real Estate Lawyers Blog

Pope Francis’ first visit to the United States has managed to inspire numerous people. Yesterday’s speech before Congress mesmerized all of those in attendance, regardless of their religious or political affiliation. The Pope’s message has been unifying to all witnesses, which is why many people have been so excited by his visit, even though many of us are not Catholic and may not agree with his specific positions.

Pope Francis’ first visit to the United States has managed to inspire numerous people. Yesterday’s speech before Congress mesmerized all of those in attendance, regardless of their religious or political affiliation. The Pope’s message has been unifying to all witnesses, which is why many people have been so excited by his visit, even though many of us are not Catholic and may not agree with his specific positions.

News outlets have

News outlets have  A

A  May and June of each year tend to be “annual meeting season” for our cooperative and condominium clients. At such meetings, the shareholders of cooperatives and unit owners of condominiums elect their board of directors or board of managers. Those who serve on boards are hard working volunteers, participating on a weekly if not daily basis. Those who attend annual meetings may only attend one meeting a year to question and judge those who participate on their behalf on a constant basis. This blog post will address how to properly conduct annual meetings and why smoothly run annual meetings are important. Although our law firm also conducts annual meetings for condominiums and religious corporations, this post will be limited to cooperative corporation annual meetings.

May and June of each year tend to be “annual meeting season” for our cooperative and condominium clients. At such meetings, the shareholders of cooperatives and unit owners of condominiums elect their board of directors or board of managers. Those who serve on boards are hard working volunteers, participating on a weekly if not daily basis. Those who attend annual meetings may only attend one meeting a year to question and judge those who participate on their behalf on a constant basis. This blog post will address how to properly conduct annual meetings and why smoothly run annual meetings are important. Although our law firm also conducts annual meetings for condominiums and religious corporations, this post will be limited to cooperative corporation annual meetings. it merely needs to hold its meetings at regular intervals each year. The By-Laws specify that the notice of annual meeting is to state that the business to be conducted is to elect directors and to conduct other business specifically identified in the notice, should state the time, date and place of the meeting, and who needs to sign the meeting notice.

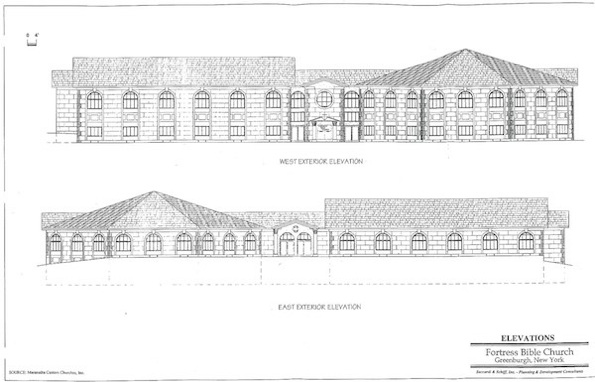

it merely needs to hold its meetings at regular intervals each year. The By-Laws specify that the notice of annual meeting is to state that the business to be conducted is to elect directors and to conduct other business specifically identified in the notice, should state the time, date and place of the meeting, and who needs to sign the meeting notice.  In 1999, the Town Board of Greenburgh, located in Westchester County, New York, reviewed an application of the Fortress Bible Church to build a church and school on land that it owned within the Town borders. After review by the Town Board, the Board rejected the application, claiming that there were safety concerns regarding inadequate stopping distance from the main road to the Church entrance, as well as general safety issues related to traffic entering and exiting the Church site.

In 1999, the Town Board of Greenburgh, located in Westchester County, New York, reviewed an application of the Fortress Bible Church to build a church and school on land that it owned within the Town borders. After review by the Town Board, the Board rejected the application, claiming that there were safety concerns regarding inadequate stopping distance from the main road to the Church entrance, as well as general safety issues related to traffic entering and exiting the Church site.

A

A