In the New York metropolitan area, the residential real estate market is often seasonal. During the holidays between Thanksgiving and New Years Day, most sellers do not list their properties for sale or may remove their home from active listing status. During the winter months, most buyers are reluctant to be exposed to the cold weather and the snow to view properties. Fortunately, all of this changes with the approach of spring. The inventory of homes increases as more properties are listed and additional purchasers are looking to enter transactions. Both parties to transactions, who will experience increased competition as inventory increases, should take the steps described in this post so as not to miss the spring season.

In the New York metropolitan area, the residential real estate market is often seasonal. During the holidays between Thanksgiving and New Years Day, most sellers do not list their properties for sale or may remove their home from active listing status. During the winter months, most buyers are reluctant to be exposed to the cold weather and the snow to view properties. Fortunately, all of this changes with the approach of spring. The inventory of homes increases as more properties are listed and additional purchasers are looking to enter transactions. Both parties to transactions, who will experience increased competition as inventory increases, should take the steps described in this post so as not to miss the spring season.

The school calendar is also strongly influential on real estate transactions in the New York suburbs. The optimal time to close for both parties is between the end of June and the beginning of September, so that the children of the selling family can complete their current school year and the children of the purchasing family can start the next school year in a timely fashion. When representing purchasers, our attorneys confirm that the property is in the school district expected by the purchasers. If the closing may occur close to, but not in advance of the start of school, we will contact the school district to determine whether the children of the purchasing family can start school prior to the closing. We will provide any documentation requested by the school district to assist in enrollment. Our lawyers will creatively fashion a solution so that the closing can occur as needed to enroll the children in school.

The following steps should be undertaken by sellers considering bringing their property to market. The home should be physically ready, so that is shows more favorably, bringing the best price to the seller. For instance, decluttering should be done to make the rooms and closets seem larger and to make it easier to move when the time comes. Since painters get busy in the spring, appointments should be made to freshen up the look of the home. Did the winter cause any property damage such as leaks, broken gutters and the like? If so, repairs should be made before bringing the property to market.

Many people who pass away also leave behind the place in which they resided. The housing could be a rental apartment, a cooperative or condominium unit, or a house. The deceased may not necessarily have resided in the property immediately before death if they went to assisted living or a nursing home. This blog post will address the legal and practical matters arising from housing of the deceased.

Many people who pass away also leave behind the place in which they resided. The housing could be a rental apartment, a cooperative or condominium unit, or a house. The deceased may not necessarily have resided in the property immediately before death if they went to assisted living or a nursing home. This blog post will address the legal and practical matters arising from housing of the deceased.

Many parties to real estate transactions focus not only on the house or the

Many parties to real estate transactions focus not only on the house or the  Every person who dies, whether wealthy or not, will owe money. Whether there is a credit card balance outstanding or estate taxes due to the State of New York, most people will leave this world with a financial obligation of some type. The questions to be addressed in this blog post involve how the fiduciary of the estate should address such debts and whether the fiduciary is personally responsible for the debts. Also, should debts of the deceased be deducted from estate proceeds before distribution to beneficiaries?

Every person who dies, whether wealthy or not, will owe money. Whether there is a credit card balance outstanding or estate taxes due to the State of New York, most people will leave this world with a financial obligation of some type. The questions to be addressed in this blog post involve how the fiduciary of the estate should address such debts and whether the fiduciary is personally responsible for the debts. Also, should debts of the deceased be deducted from estate proceeds before distribution to beneficiaries? One of the most frequently asked questions when our firm meets with a new client relates to the awarding of attorney’s fees. Many of our landlord-tenant clients ask us whether they can recover their attorney’s fees in Court from the other party in the litigation. The answer to this question is not a simple one, and this blog post will answer under what circumstances a party may recover their attorney’s fees from the other party, whether in a landlord-tenant litigation, or other type of case.

One of the most frequently asked questions when our firm meets with a new client relates to the awarding of attorney’s fees. Many of our landlord-tenant clients ask us whether they can recover their attorney’s fees in Court from the other party in the litigation. The answer to this question is not a simple one, and this blog post will answer under what circumstances a party may recover their attorney’s fees from the other party, whether in a landlord-tenant litigation, or other type of case.

First, we would like to wish all followers of our blog a happy and healthy 2015. We look forward to continued successful legal outcomes for all of our clients in the New Year.

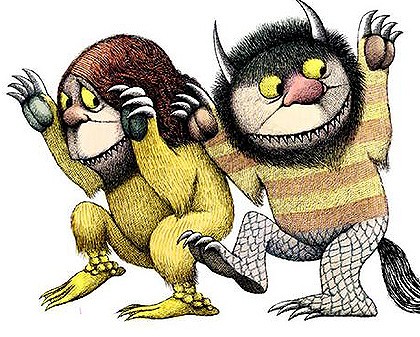

First, we would like to wish all followers of our blog a happy and healthy 2015. We look forward to continued successful legal outcomes for all of our clients in the New Year.  Maurice Sendak was a beloved children’s book author and illustrator whose death two years ago has

Maurice Sendak was a beloved children’s book author and illustrator whose death two years ago has A

A