Non-Payment Proceedings – Handling them the Right Way

A recent article in the New York Post reports on the tragic story of a New York City landlord who claimed he was “under pressure” and had “a lot of issues” with his tenants, namely, that they were late paying rent. Unfortunately, the landlord responded to the situation by murdering his tenants, for which he has now been arrested and is in police custody.

A recent article in the New York Post reports on the tragic story of a New York City landlord who claimed he was “under pressure” and had “a lot of issues” with his tenants, namely, that they were late paying rent. Unfortunately, the landlord responded to the situation by murdering his tenants, for which he has now been arrested and is in police custody.

Obviously, this is the wrong way for a landlord to handle tenants who have not paid their rent. What should the landlord have done instead? This blog post will discuss the proper manner in which non-paying tenants should be dealt.

Almost all tenants are required to pay rent when leasing property, such as an apartment or a house. To simplify, we will discuss residential, rather than commercial tenants, in this post.

I’ll Be There for You: Legal Issues Raised by Beloved Actor’s Death

The recent death of Matthew Perry, best known for playing “Chandler Bing” on the popular sitcom Friends, has deeply affected many of our readers. Although Perry was known for his fabulous sense of humor, the dark side of his life was notable for his addiction to alcohol and drugs, almost causing his death numerous times. His painful life was documented in his memoir entitled Friends, Lovers and the Big Terrible Thing.

The recent death of Matthew Perry, best known for playing “Chandler Bing” on the popular sitcom Friends, has deeply affected many of our readers. Although Perry was known for his fabulous sense of humor, the dark side of his life was notable for his addiction to alcohol and drugs, almost causing his death numerous times. His painful life was documented in his memoir entitled Friends, Lovers and the Big Terrible Thing.

The Emmy nominated actor may be “The One with Estate Issues.” Although this author is not privy to the details of Mr. Perry’s estate, this post will discuss some of the estate concerns that could arise. Mr. Perry died at his home in California. Most if not all of Mr. Perry’s estate will be determined by California law as a result. However, if he happened to have owned a pied-a-terre in Manhattan, the disposition of that property would be determined by an ancillary proceeding in New York after the completion of any California proceeding. The remainder of this post will address the legal result as if Mr. Perry had died in New York, since the legal matters covered by this blog deal with New York law.

It must be determined whether or not Mr. Perry had a Will. If there was a Will, it would be subject to a probate proceeding, whereby the Will would be submitted to the Surrogate’s Court and Letters Testamentary would be issued to the named Executor. In order for a Will to be valid, the testator (person making the Will) needs to have mental capacity and not be impaired by alcohol or drugs when signing the document. Certainly, a person such as Mr. Perry may have had issues concerning mental capacity when signing a Will. However, experienced attorneys who properly conduct the will execution ceremony will not proceed if their client appears impaired at the time of signing. Likewise, the witnesses should simultaneously sign a “self-proving affidavit” whereby they are confirming that the testator was of sound mind and under no physical or mental impairment that would affect his capacity to make a valid Will.

Let the Buyer Beware?

Caveat emptor is a Latin phrase loosely translated to mean “let the buyer beware.” Real estate in New York State has customarily been transferred under this concept, meaning that the seller is not obligated to disclose property conditions and the onus is on the buyer to discover conditions that may be objectionable. In 2001, this concept eroded somewhat with the enactment of Article 14 of the Real Property Law, known as the property condition disclosure statement law (“PCDSL”). Sellers of residential property were required to complete a lengthy questionnaire concerning property conditions. If the seller preferred not to complete the form, the seller was required to issue a $500 credit to the buyer at the closing, as was customary in downstate counties serviced by our firm.

Caveat emptor is a Latin phrase loosely translated to mean “let the buyer beware.” Real estate in New York State has customarily been transferred under this concept, meaning that the seller is not obligated to disclose property conditions and the onus is on the buyer to discover conditions that may be objectionable. In 2001, this concept eroded somewhat with the enactment of Article 14 of the Real Property Law, known as the property condition disclosure statement law (“PCDSL”). Sellers of residential property were required to complete a lengthy questionnaire concerning property conditions. If the seller preferred not to complete the form, the seller was required to issue a $500 credit to the buyer at the closing, as was customary in downstate counties serviced by our firm.

Recently, Governor Kathy Hochul signed an amendment to the PCDSL that added disclosures concerning flood risks and history. Most significantly, the amendment, which becomes effective on March 20, 2024, removes the seller’s option to issue a $500 credit to the buyer and requires the completion of the questionnaire before the contract is signed. The law explicitly states that it is not a warranty by the seller and does not substitute for inspections that the buyer may conduct. Typically, a real estate agent or experienced real estate attorney will recommend that the buyer hire a professional inspector to evaluate property conditions. Inspectors will often discover concerns such as asbestos in the furnace room. A qualified attorney may integrate repair issues in contract negotiations. Armed with additional information from the completed disclosure form, a buyer may threaten to walk away from a transaction without additional contractual concessions.

The new law provides that knowingly false or incomplete statements made by the seller can subject the seller to claims after the closing. This is a departure from standard New York law whereby the buyer’s acceptance of the deed at the closing is deemed to be full acceptance of any property conditions, whether known or unknown to the buyer.

Who has the Power?

News outlets have recently reported that Senator Dianne Feinstein has given a power of attorney to her daughter. Concerns over the Senator’s mental competency have arisen as a result. For the reasons discussed in this post, appointing an agent by power of attorney does not necessarily mean that one is incompetent to handle one’s legal and financial affairs.

News outlets have recently reported that Senator Dianne Feinstein has given a power of attorney to her daughter. Concerns over the Senator’s mental competency have arisen as a result. For the reasons discussed in this post, appointing an agent by power of attorney does not necessarily mean that one is incompetent to handle one’s legal and financial affairs.

In New York State, there are various types of powers of attorney, governed by a provision of the General Obligations Law. In all cases, the person making the power of attorney is the principal who appoints a person or persons to act on one’s behalf, an agent. The standard form of power of attorney appoints one or two agents, who may or may not be required to act together. Up to any of fifteen legal actions can be authorized or all fifteen actions can be authorized. Some examples of the actions that could be authorized include real estate transactions, banking, insurance and tax matters. The document needs to be initialed and signed by the principal, as well as notarized and witnessed by two persons. The agent cannot be a notary or witness to the document, but the agent needs to sign a portion of the document before a notary accepting the role as agent. This type of power of attorney is effective immediately and is not dependent upon whether a person is competent.

The standard power of attorney can also limit the agent to acting with respect to a specific matter. For instance, if the principal will not be attending her house closing, she can appoint her attorney for the limited purpose of all matters required to complete a specific transaction. In this case, only some of the fifteen potential actions will be authorized. This limitation protects both the principal and the agent, since the agent cannot conduct actions beyond those required for the closing. The agent appointed could be a spouse or other relative, a friend or one’s attorney. Depending upon the closeness of the relationship and the degree of trust, the principal will decide whether the authority should be immediate or limited in any way.

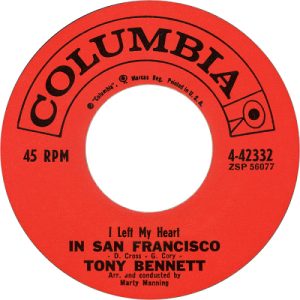

From Rags to Riches: Legal Issues Raised by the Death of Tony Bennett

Tony Bennett was beloved by those young and old not only as a talented singer, but as a World War II veteran and civil rights icon. His recent death at the age of 96 was not unexpected. This post will identify the legal issues that may be raised when a person such as Tony Bennett passes.

Tony Bennett was beloved by those young and old not only as a talented singer, but as a World War II veteran and civil rights icon. His recent death at the age of 96 was not unexpected. This post will identify the legal issues that may be raised when a person such as Tony Bennett passes.

Mr. Bennett could be considered to have been in a New York State of Mind, having been born and dying in New York State. He was considered to be well-liked by all, except for potentially his two ex-wives who may have said “I’ve Got You Under My Skin” as they completed their divorce proceedings. We have posted previously as to whether an estranged or divorced spouse has the legal right to inherit. Even a promise to include an ex-spouse in one’s Will, as may be desirable in resolving a divorce proceeding, is not enforceable in New York. Unless Mr. Bennett had explicitly left assets to his ex-wives in a Will or Trust, these ex-spouses would not have a valid claim to his estate.

The admired crooner was married to his third wife at the time of his death. Potentially his most recent wife had a conflict with his four children, whose mothers were either his first or second wives. In addition, two of his four children assisted Mr. Bennett in his career, so he may have wanted to leave them more assets or they stand to gain other financial benefits from having worked alongside their father. It should be noted that Mr. Bennett’s two daughters were also the children of his second wife and but were born before their marriage. If Tony had no Will, an estate administration would need to be conducted and proof of paternity would need to be established so that his daughters could legally inherit from his estate.