One of this author’s first lessons in Property Law class involved the concept of adverse possession. Under this legal principle, one party may acquire title to the property belonging to another. In New York, the elements required to establish adverse possession in the governing statute have been modified after 2008.

One of this author’s first lessons in Property Law class involved the concept of adverse possession. Under this legal principle, one party may acquire title to the property belonging to another. In New York, the elements required to establish adverse possession in the governing statute have been modified after 2008.

Prior to 2008, the following items had to be proven in order to establish the right to acquire title through adverse possession: hostile/adverse with claim of right/title (meaning that the possessor must believe that he owns the property); actual (an act on the part of the possessor must be conducted on the subject property); open/notorious (the possessor must be acting in a manner that an observant property owner would be able to see their activity); exclusive (if a fence, gate or wall is installed it may prevent other parties from entry and make the possession exclusive to the possessor); continuous for ten years (the owner is out-of-possession for at least ten years); and likely to be cultivated or improved (gardening, lawn mowing and the like have been conducted by the possessor or the possessor built a structure such as a shed or other building) or protected by an enclosure (such as a gate or fence). Permissive use does not give rise to an adverse possession claim.

As a result of the New York recent case known as Walling v. Pryzyble , the “hostile” element from the adverse possession standards has been removed. Further, property need not be cultivated or improved to give rise to an adverse possession claim. The updated standard is that there is a reasonable belief that the property belongs to the possessor.

A

A  After another harsh winter in New York, many of us are looking forward to getting away this Memorial Day weekend. Those of us who are driving may have acquired the vehicle from an estate. This post will address

After another harsh winter in New York, many of us are looking forward to getting away this Memorial Day weekend. Those of us who are driving may have acquired the vehicle from an estate. This post will address  Parties to real estate transactions often ask

Parties to real estate transactions often ask

News outlets have

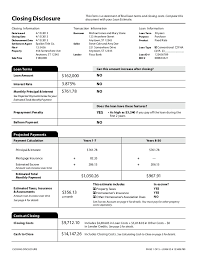

News outlets have  Our readers who have attended residential real estate closings are familiar with the

Our readers who have attended residential real estate closings are familiar with the  A

A